It could also mean that the company is asset-heavy and may not be generating adequate revenue relative to the assets it owns. That said, if a company’s asset turnover is extremely high compared to its peers, it might not be a great sign. It may indicate management is unable to invest enough to boost the business to its full potential. Spending more by investing in more revenue-producing assets may lower the asset turnover ratio, but it could provide a positive return on investment for shareholders. Management should be working to maximize profits even if the next investment isn’t quite as profitable as the last. If a company’s total asset turnover ratio is below 1, it indicates that it is generating sales that are less than its total asset base.

What is the Total Asset Turnover Ratio?

This is often the case for many service industries, including insurance companies, energy suppliers, and information technology firms. For this reason, you should always make a point of comparing your results with other companies in the same industry. As such, the numbers indicate Walmart has higher sell-through rates on its inventory and makes better use of its assets. Indeed, Walmart has done well to expand its curbside pickup and delivery service for online ordering, leading to greater utilization of its stores.

- • Fixed assets are generally physical items such as equipment or real estate.

- Knowing how to calculate asset turnover and how to use it to identify companies with competitive advantages can help uncover good investment opportunities.

- By analyzing TAT, investors can discern trends in efficiency and performance that may influence investment decisions.

- This is a good measure for comparing companies in similar industries, and can even provide a snapshot of a company’s management practices.

How Can a Company Improve Its Asset Turnover Ratio?

Companies should strive to maximize the benefits received from their assets on hand, which tends to coincide with the objective of minimizing any operating waste. Diane Costagliola is a researcher, librarian, instructor, and writer who has published articles on personal finance, home buying, and foreclosure. Generally speaking, a higher ratio is a more desirable outcome for most businesses.

Low vs. High Asset Turnover Ratios

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. You quality operations manager can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here). • Fixed assets are generally physical items such as equipment or real estate. Suppose a company generated $250 million in net sales, which is anticipated to increase by $50m each year.

As such, asset turnover may be better utilized in conjunction with profitability ratios. A retailer whose biggest assets are usually inventory will have a high asset turnover ratio. A software maker, which might not have very many assets at all, will have a high asset turnover ratio, too. But a machine manufacturer will have a very low asset turnover ratio because it has to spend heavily on machine-making equipment. Investors can use the asset turnover ratio to help identify important competitive advantages.

Different sectors display varying norms for asset turnover due to their unique operational characteristics. For example, capital-intensive industries have lower asset turnover due to higher investment in assets, while less asset-heavy sectors may exhibit higher turnover rates. Consequently, fixed asset turnover ratios should be compared within the context of an industry to gauge a company’s efficiency relative to its peers. The asset turnover ratio helps investors understand how effectively companies are using their assets to generate sales. Investors use this ratio to compare similar companies in the same sector or group to determine who’s getting the most out of their assets.

This can imply poor utilization of assets or reflect the industry’s capital-intensive nature. TAT varies significantly across different industries due to varying capital intensity. Lower ratios are common for enterprises within capital-heavy industries, like manufacturing, as they require substantial PP&E investments.

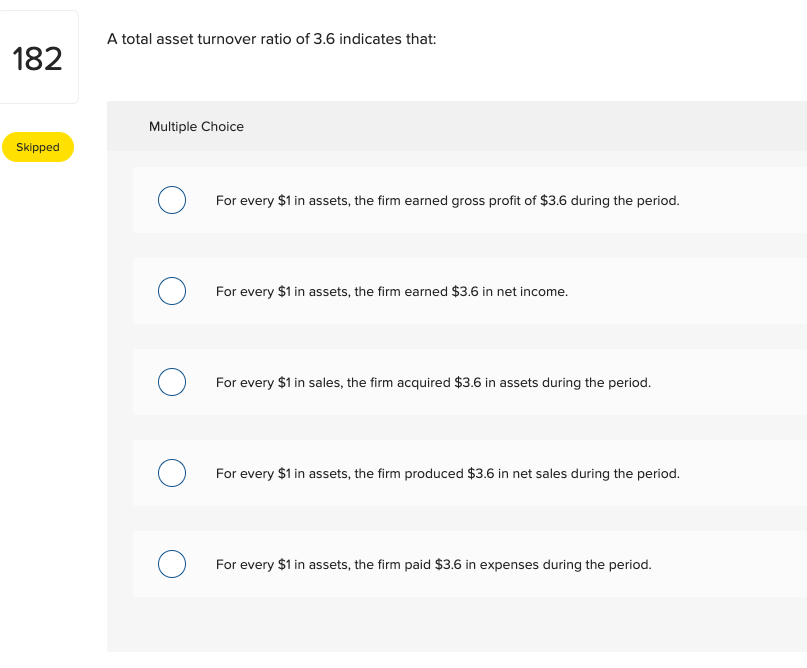

The asset turnover ratio is calculated by dividing net sales or revenue by the average total assets. The asset turnover ratio measures how effectively a company uses its assets to generate revenues or sales. The ratio compares the dollar amount of sales or revenues to the company’s total assets to measure the efficiency of the company’s operations. Understanding how to compute the total asset turnover can highlight the effectiveness of a company’s management and its operative strategy. The ratio is typically calculated by dividing net sales by average total assets, indicating how many dollars in sales a company generates for each dollar invested in assets.

Any fluctuation in sales will affect the ratio, making it a vital aspect to analyze. Operational strategies that aim to increase sales without necessarily increasing the asset base can improve this turnover ratio, indicating a more efficient use of assets in generating revenue. This implies that Company Z generates approximately $1.45 in sales for every dollar in average total assets. Industry averages provide a good indication of a reasonable total asset turnover ratio. Since each industry has its own standards for a “good” asset turnover ratio, there isn’t one specific number to look for.

Mostly, it comes down to the fact that as a single ratio, which doesn’t reveal the total health or financial picture for a single company. For that reason, it’s probably a good idea to use the ratio in tandem with other analysis tools and methods. Asset turnover ratio is a calculation used to measure the value of a company’s assets relative to its sales or revenue.

Sometimes investors also want to see how companies use more specific assets like fixed assets and current assets. The fixed asset turnover ratio and the working capital ratio are turnover ratios similar to the asset turnover ratio that are often used to calculate the efficiency of these asset classes. Publicly-facing industries including retail and restaurants rely heavily on converting assets to inventory, then converting inventory to sales. Other sectors like real estate often take long periods of time to convert inventory into revenue.