In the fast-paced world of Forex trading, having a structured framework can significantly enhance your chances of success. Understanding the foundational principles is crucial, and at forex trading framework professional guidelines forex-level.com, you can find valuable insights and resources. This article will outline a professional Forex trading framework that incorporates essential guidelines, strategies, and tips to help traders navigate the complexities of the foreign exchange market.

Understanding Forex Trading

The foreign exchange market, known as Forex, is the largest and most liquid financial market in the world, where currencies are traded against one another. Traders engage in Forex trading by speculating on the price movements of currency pairs, aiming to profit from fluctuations in their values. A structured trading framework is vital for both novice and experienced traders to make informed decisions and manage risks effectively.

1. Establishing Your Trading Goals

The first step in developing a Forex trading framework is clearly defining your trading goals. Determine what you aim to achieve through trading—whether it is generating a supplemental income, achieving financial independence, or simply honing your analytical skills. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals will help you stay focused and maintain discipline as you navigate the market.

2. Understanding Market Mechanics

Before diving into trading, it is essential to understand the fundamental mechanics of the Forex market. This includes grasping the concept of currency pairs, pips, lots, and leverage. Familiarize yourself with how economic indicators affect currency values and keep track of news events that could influence market volatility. A solid understanding of market mechanics will allow you to make informed trading decisions.

3. Developing a Trading Strategy

Having a robust trading strategy is the backbone of a successful Forex trading framework. Your strategy should incorporate technical analysis, fundamental analysis, and risk management practices. Here are some components to consider:

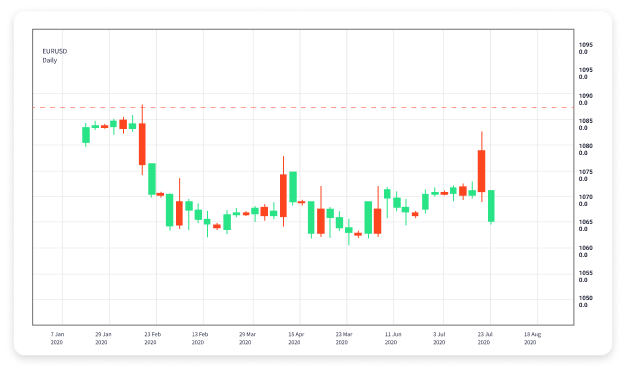

- Technical Analysis: Utilize chart patterns, indicators, and historical data to identify potential trading opportunities.

- Fundamental Analysis: Analyze economic reports, central bank decisions, and geopolitical events to understand the broader market narrative.

- Risk Management: Implement strict rules regarding position sizing, stop-loss orders, and profit targets. Manage risk to ensure that you do not expose yourself to undue financial hardship.

4. Choosing the Right Trading Tools

The right tools and platforms can enhance your trading experience. Consider the following when selecting trading tools:

- Trading Platform: Choose a reliable trading platform that offers a user-friendly interface, advanced charting tools, and real-time data feeds.

- Technical Indicators: Explore various indicators such as Moving Averages, Bollinger Bands, and Relative Strength Index (RSI) to assist in your analysis.

- Automated Trading Software: Consider using Expert Advisors (EAs) for algorithmic trading to execute trades automatically based on predetermined criteria.

5. Keeping a Trading Journal

Maintaining a trading journal is a valuable practice that enables you to track your trades, assess your strategies, and learn from past performance. Document details such as entry and exit points, the reasoning behind your trades, and the outcomes. Regularly review your journal to identify patterns in your trading behavior, helping you refine your approach and avoid repeated mistakes.

6. Continuous Learning and Adaptation

The Forex market is constantly evolving, influenced by global economic trends and events. As a trader, it is vital to stay updated on market developments and continuously improve your skills. Engage in educational resources such as webinars, online courses, books, and forums. Networking with other traders can provide alternative perspectives and insights that can enhance your trading knowledge.

7. Psychological Aspects of Trading

Trading can be emotionally taxing, and managing your psychology is essential for success. Develop mental discipline and resilience to cope with the inevitable ups and downs of trading. Key psychological principles to consider include:

- Emotional Control: Avoid making impulsive decisions driven by emotions such as fear and greed. Stick to your trading plan.

- Patience: Wait for high-probability setups that align with your trading strategy rather than forcing trades.

- Trade Consistency: Implement your strategy consistently while remaining adaptable to changing market conditions.

8. Evaluating Performance

Periodic evaluation of your trading performance is vital for growth. Set aside time to assess your results regularly. Identify what strategies worked, what did not, and why. Focus on process rather than outcomes, and refine your approach based on empirical evidence from your trading history.

Conclusion

A professional Forex trading framework is a blend of strategic planning, risk management, continuous learning, and psychological fortitude. By following the guidelines outlined in this article, traders can create a robust framework tailored to their unique goals and risk tolerance. Remember, success in Forex trading does not come overnight; it requires commitment, discipline, and an unwavering focus on improvement. With the right approach and mindset, you can navigate the Forex market with confidence.